The following is a brief introduction to the topic:

The price is determined by the interplay between demand and supply in a given market. The willingness of producers and consumers to buy and sell is represented by demand and supply. When buyers and sellers agree on a price, they can exchange a product.

In this section, the Agriculture Marketing Manual describes prices in a market that is competitive. Prices may vary when there is imperfect competition, as in the case of a single-selling firm or monopoly.

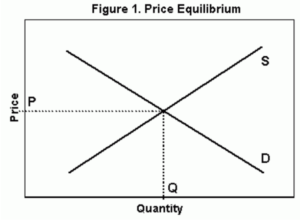

Equilibrium Price

The price agreed upon by both parties in a transaction is called an equilibrium price. It’s also known as the market clearing price. This price can be represented graphically by the intersection between demand and supply as shown in Image 1.

Image 1 shows that both the buyers and the sellers would be willing to exchange the quantity Q for the price P. Both factors are equally important in determining price.

This is a true market balance. Consider what happens when an imbalance occurs, as in the case of the P designated on Image 1 when the price of the market falls below it.

A price lower than P will lead to an oversupply of the product. This can result in shortages. As a result, the consumer may choose to pay more to get the desired product. The producer is then incentivized to produce the item.

In the end, supply and demand reach equilibrium at P. If a price arbitrarily set higher than P is applied, it will result in a surplus, where the supply exceeds demand. This scenario may result in producers accepting a lower selling price, while consumers are enticed to buy more by the lower price. Only when prices decrease can the balance be restored.

The market price isn’t a price that is fair by definition; it is just a result. The market price does not ensure complete satisfaction to both buyers and sellers. Market prices are rationalized by assumptions about buyer and seller behavior like that buyers will act in their own self-interest and profit maximization is the goal of sellers.

Change in Equilibrium Prices

A change in demand or supply will result in a shift in equilibrium prices. In the section Understanding Supply Factors, we explain why market components change. These examples show the price impact of such changes.

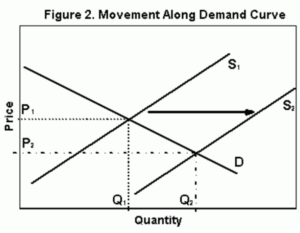

Example 1: Increased output due to unusually good weather

The price falls from P1 down to P2 when a bumper crop leads to an increased supply (S2 on Image 2).

If the curve of demand is vertical, then the adjustments in price and quantity needed to achieve a new equilibrium will be different than if it was more elastic.

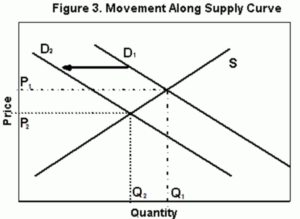

Example 2: Customers lower their preference for beef

The demand curve shifts inwards (as shown in Image 3), which causes a decrease in both price and quantity.

Price Stability

The size of price changes is influenced by two factors: the magnitude of the change and the degree of elasticity of supply or demand. A large shift in the supply curve may have only a small impact on the price, for example, if the demand curve is elastic. This would be evident in Example 1 if the demand curve was drawn flatter (more elastic).

In comparison to many industrial goods, the elasticity of supply and demand for agricultural products is relatively low. In agriculture, this inelasticity in demand can lead to price instabilities when supply and demand change in the short term.

VISIT ALSO: How does inflation impact the economy?

Price Level

In the two cases above, we have focused on short-term factors which can affect supply and demand. But there are longer-term factors at play that can also affect supply and demand. Technology is one of the main supply-shifters. Technology has had a major impact on agriculture by shifting the curve quickly outwards.

In the long term, technology has driven down agricultural prices because producers are able to produce more for less. Both population and income are increasing, and this tends to push demand in the direction of the right. It is a complex net effect, but the combination of a rapidly changing supply curve and sluggish demand led to lower prices in agricultural products compared with industrial goods.

yle=”font-weight: 400;”>>Supply and demand are unique at different levels, such as the farm gate or retail. Prices at various market levels are likely to be related. If hog prices fall, then it is reasonable to expect that pork retail prices will also drop. The price adjustment will be more likely in the future after all parties have adjusted their behaviors.

Price adjustments are not always possible in the short term for various reasons. Wholesalers might have contracts with long-term prices for the old hog or retailers could have planned or advertised a special to draw customers.

You can read more about it here:

- <span class=”yoast-text-mark” style=”font-weight: 400;”>>Demand and supply are interdependent factors that affect market prices.

- A price that is in equilibrium represents the balance between factors such as demand and supply.

- Prices tend to return to equilibrium unless the characteristics of demand or supply change.

- -level=”1″>>Demand supply or both can shift the equilibrium price.